13+ Capm Calculator

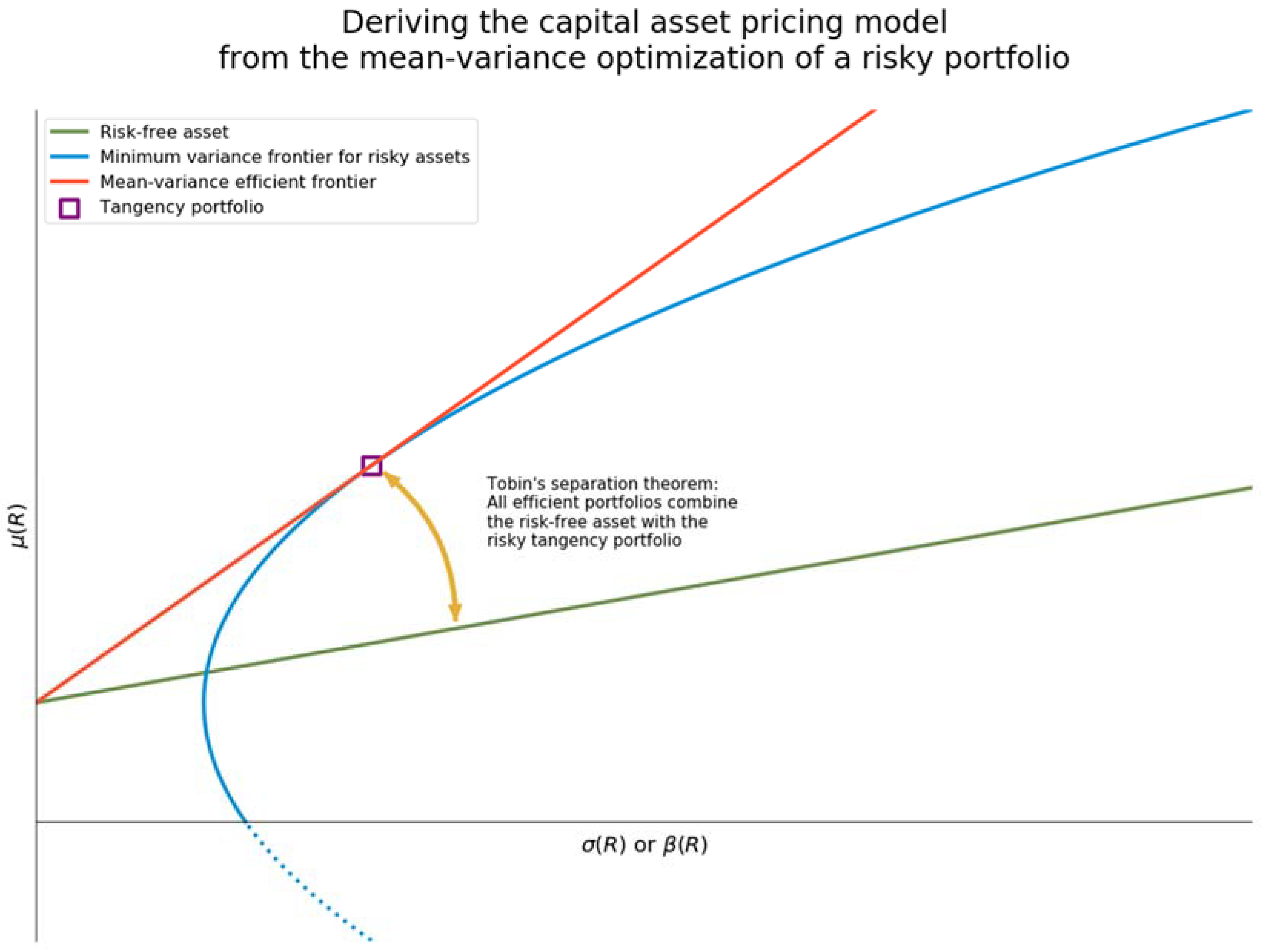

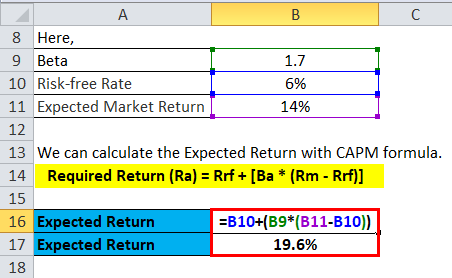

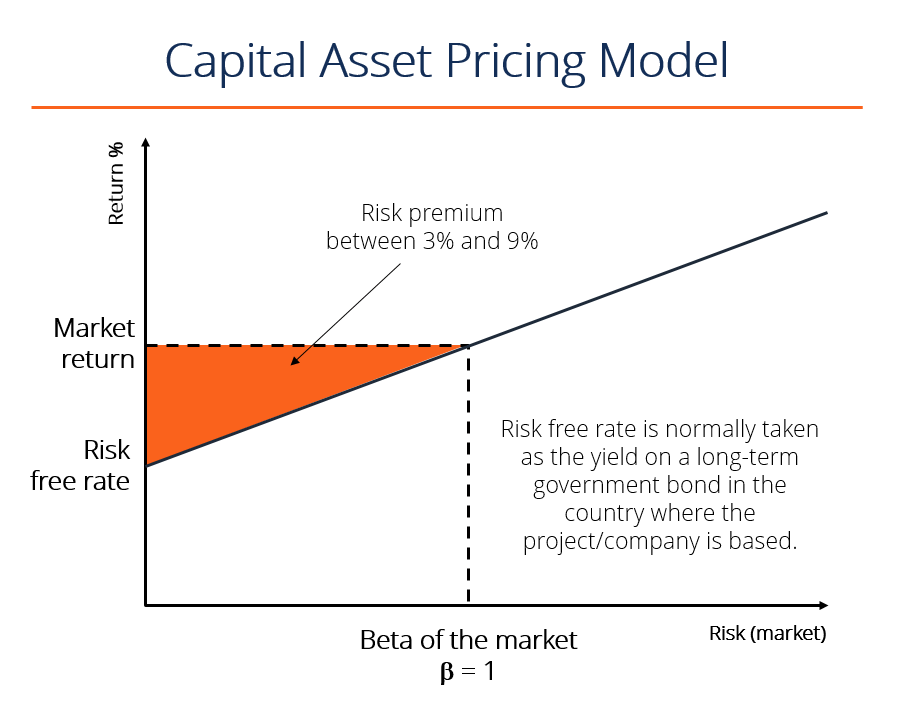

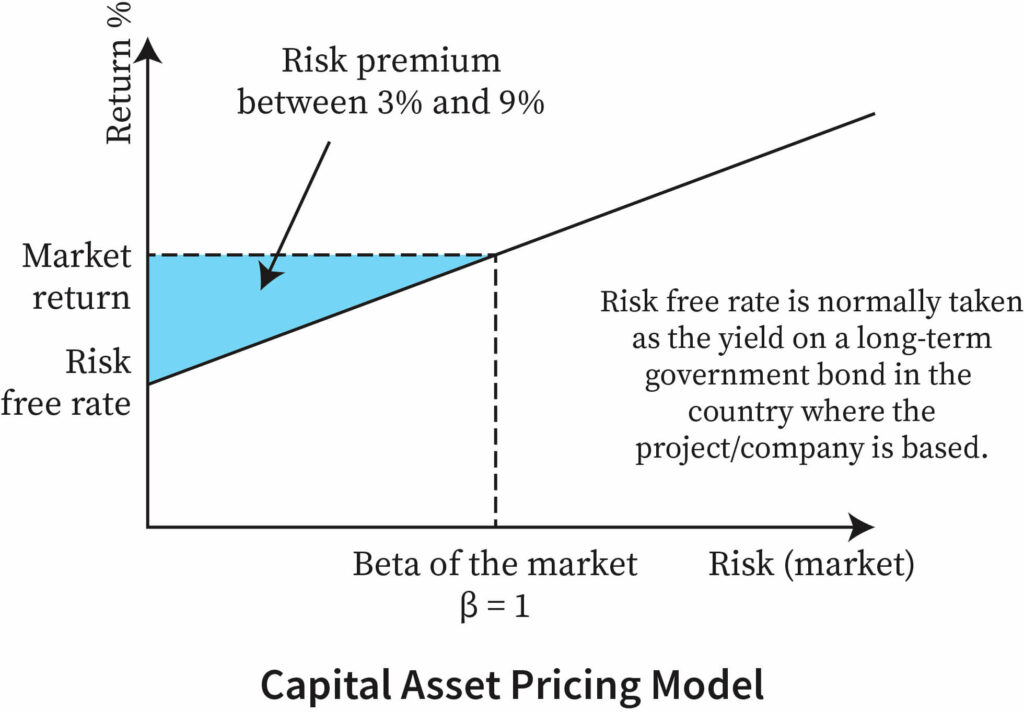

Beta in the CAPM model is. The Capital Asset Pricing Model or CAPM is a basic theoretical model for determining the expected return on a security or portfolio.

Encyclopedia Free Full Text The Capital Asset Pricing Model

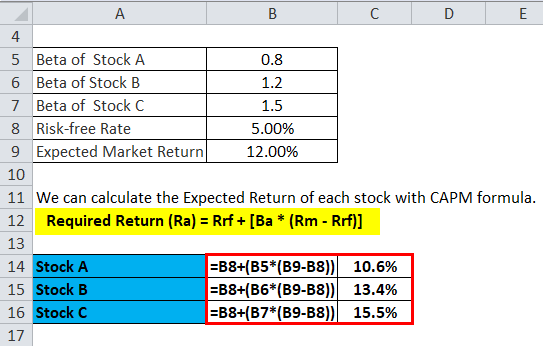

The Capital Asset pricing model CAPM calculator allows you to determine the current expected return of a specific stock when factoring investment risk.

. CAPM Calculator The Capital Asset Pricing Model CAPM is an extremely popular model to estimate the expected return of a firm considering the market conditions the risk free level of. The capital asset pricing model CAPM is used to determine a theoretically appropriate required rate of return of an asset. The CAPM is a common stock.

This model factors in the non. In finance the CAPM capital asset pricing model is a theory of the relationship between the risk of a security or a portfolio of securities and the expected rate of return that is commensurate. In finance the CAPM model Capital Asset Pricing Model describes the relationship between the systematic risk and the expected return of the assets.

This capital asset pricing model calculator CAPM can help the investor figure out the expected return on a capital asset at a given risk level. Fortunately the CAPM capital asset pricing model lets people figure out whether the offered rate makes up for the lessened safety of many offerings. The capital asset pricing model CAPM is used to calculate expected returns given the cost of capital and risk of assets.

The Capital Asset Pricing Model CAPM is a model that describes the relationship between the expected return and risk of investing in a security. Risk free rate of return - The income that. This CAPM calculator will allow you to quickly find.

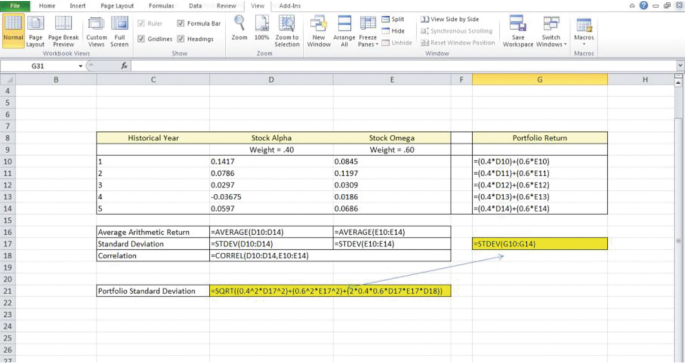

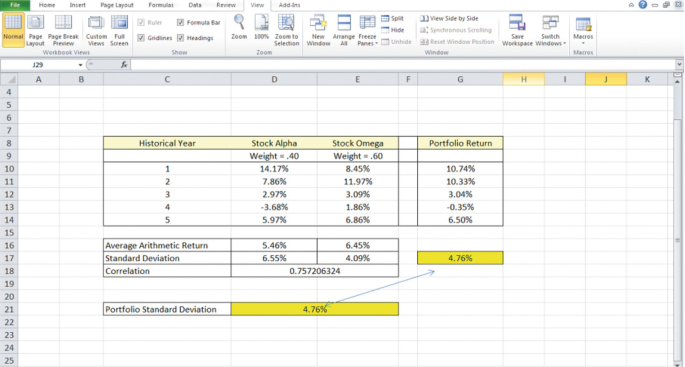

The capital asset pricing model CAPM is a model that describes the relationship between systematic risk and expected return for assets. Weighted Average Cost of Capital Calculator. The expected return by common shareholders is equal to the risk-free rate plus the product of beta and the.

Stock Non-constant Growth Calculator. The result of the. The CAPM calculator can be used to solve problems based upon the Security Market Line SML from the Capital Asset Pricing Model.

It shows that the expected. Capital Asset Pricing Model - CAPM. The calculator is able to solve for any of the four.

Holding Period Return Calculator. The CAPM formula requires the rate of return for the. Per the capital asset pricing model CAPM the cost of equity ie.

The Rocky Marriage Of Risk And Return Springerlink

The Rocky Marriage Of Risk And Return Springerlink

What Levels Are Considered High Beta Stocks Low Beta Stocks And Stocks Within A Certain Range That Roughly Follow The Market Quora

2 272 Capm Images Stock Photos Vectors Shutterstock

Capm Formula Capital Asset Pricing Model Calculator Excel Template

Usuarios Internet Y Redes Sociales 2020 We Are Social Are Social

8 2 The Derivation Of The Capm

Capital Asset Pricing Model Capm Excel Template 365 Financial Analyst

Capital Asset Pricing Model Capm Financial Edge

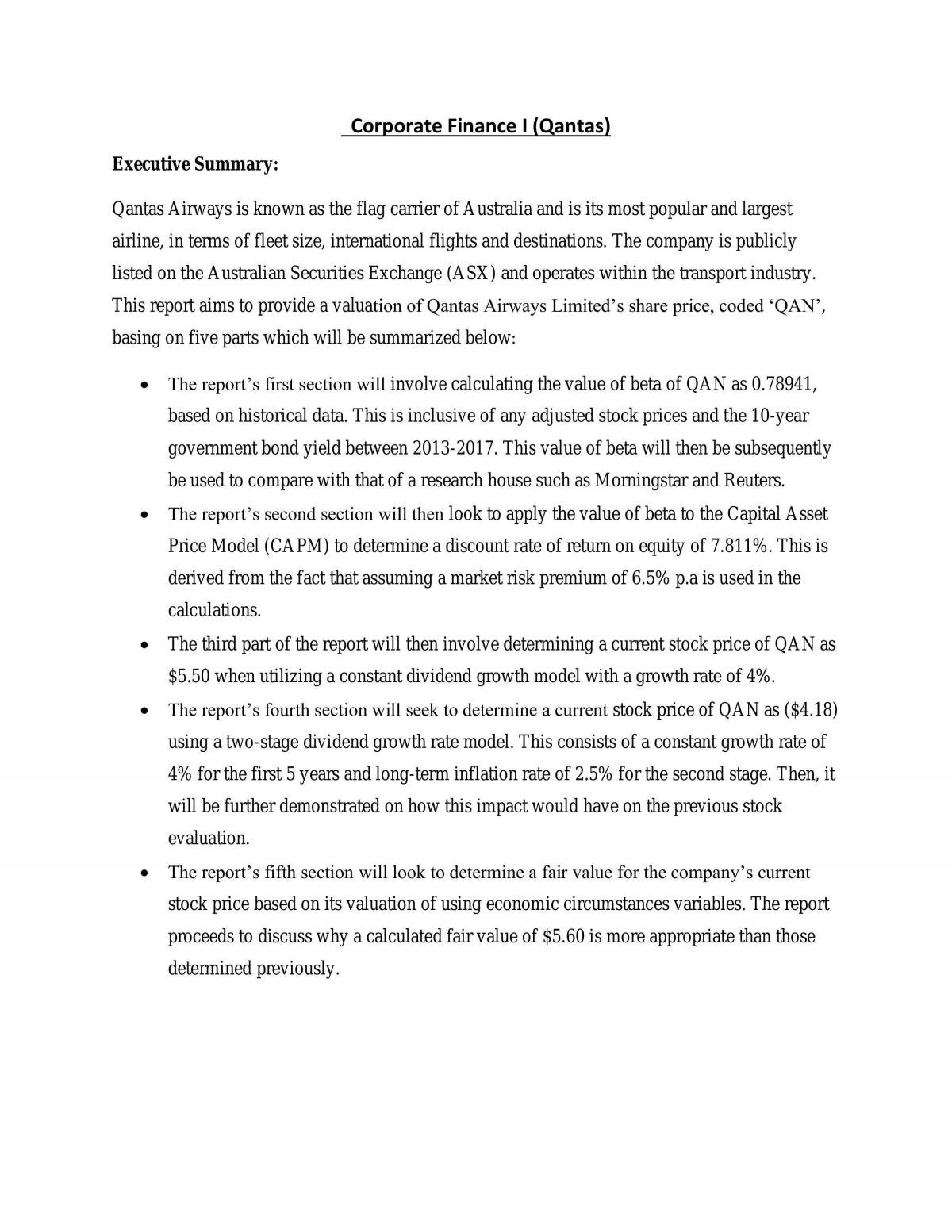

Corporate Finance 1 Assignment Finc2011 Corporate Finance I Usyd Thinkswap

What Is Capm Capital Asset Pricing Model Formula Example

Brandon Renfro Renfrophd Twitter

Capm Formula Capital Asset Pricing Model Calculator Excel Template

Capital Asset Pricing Model Bartleby

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)

What Is The Capital Asset Pricing Model Capm

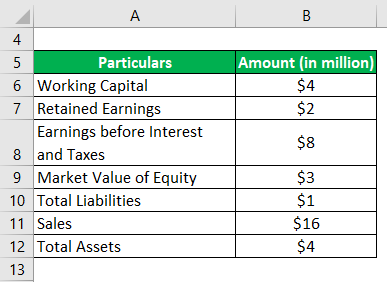

Altman Z Score Formula Step By Step Calcualtion Of Altman Z Score

:max_bytes(150000):strip_icc()/tesla-b2b7e254720442248700b97e303b201d.jpg)

What Is Capm Formula In Excel Using Capm To Analyze Risk Reward